Table of Content

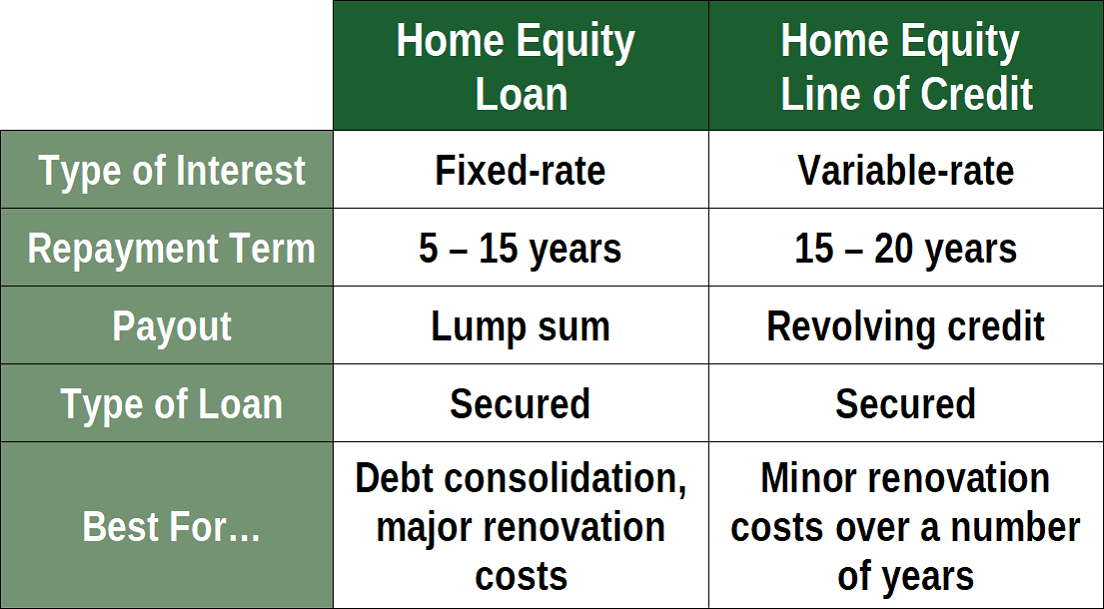

Entrust Services Group offers industry expertise and convenient services to help you streamline the loan process from start to finish. Servicing by Citadel – Citadel will be your mortgage servicer. You’ll make payments to Citadel, and we’ll be your point of contact for any questions you may have. All mortgages must close and fund with Citadel Mortgages, this offer is vaiild with any new or renewal mortgage and offer can change at any time without notice. The term “home equity loan” is used because the loan is second in priority in case of default. This means that if a borrower defaults, the first mortgage will be paid off before the home equity loan.

Download this eBook now to make the process easier and better understand the options available to you today. We’ve updated our Privacy Policy to allow our products and services to be more available to you. Please read this information carefully to learn more about your legal rights. By continuing to use our products and services, you agree to these updates.

Year ARM

Learn how to get the best ROI on pre-sale renovations. Learn & Plan Your Home is Your Biggest Asset Learn more about investing in your home and maximizing the value of your property. Learn & Plan Alternatives to Paying Off a Mortgage Depending on your financial position and life goals, paying off your mortgage early may not be in your best interest.

A rough rule of thumb is that the amount of equity you have in your home is the home’s value minus any outstanding loans on the property, like your mortgage. You can use our home equity loan calculator for a more precise calculation. Home equity loans are popular among borrowers who want to use the funds to cover large expenses, such as home improvement projects or high-interest debt consolidation. Home equity loans allow homeowners to borrow against the equity in their homes. Equity is the difference between your home’s value minus what you owe on your mortgage.

Best Mid-Tier Home Equity Loan Product

The mortgaged property must be at least 51% owner-occupied for commercial use. Offer not available to applicants with an existing Citadel commercial mortgage. Flood and/or title insurance may be required at an additional expense to the borrower. An appraisal will be required at the borrower’s expense for loans exceeding $250,000.

Payment Protection Citadel safeguards you and your family with our Member’s Choice™ Borrower Security. Auto Loans From Citadel Citadel offers some of the lowest rates on car loans in the area. View our car loan and refinance rates, estimate your payment with our calculator, and get pre-approved. Citadel offers some of the most competitive rates in the area. Use our auto refinance calculator below to understand your new monthly payment.

Up to 84 Months

The lower rate also requires automatic withdrawals from a TD Bank checking or savings account. Without automatic withdrawals, the rate increases by 0.25%. From savings to certificates, money market accounts to mortgages, Citadel has consistently better rates and lower fees. Citadel is a not-for-profit credit union built on the unshakeable promise to serve those who work every day to build a better future for us all. For over 80 years, we’ve delivered a breadth of financial services, expert guidance, and innovative tools to help strengthen and grow businesses, families, and our local communities. We are your Citadel, and we are Building Strength Together.

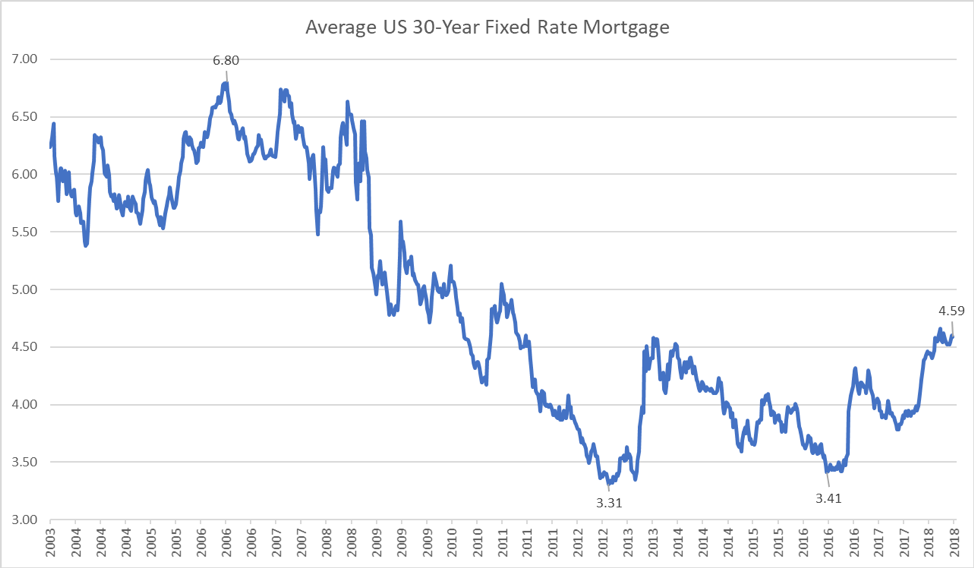

If that's the case, it likely won't make financial sense for you to refinance. Instead, you can use a home equity loan to only take out the money you need, rather than replacing your entire mortgage with a higher interest rate loan. Now, borrowers with excellent credit and sufficient equity can secure home equity loans with interest rates as low as 5% to 6%, according to Bankrate. A home equity loan, which lets you borrow money against the equity you've built in your home, provides you with a lump sum of cash at a fixed interest rate.

That’s because when you get the money all at once, you repay it according to a fixed interest rate. The APR that Fifth Third advertises is offered to borrowers with the highest credit scores and qualifications. The lowest rate also includes a 0.25% discount for borrowers who set up automatic payments from an eligible Fifth Third account. The interest rates are reflected as annual percentage rates as of December 12, 2022. We also considered each lender’s combined loan-to-value ratio requirement, which is calculated by dividing the sum of all the loans on the property by its current value. Most lenders require owners to retain a CLTV ratio of 80% or less, but some are willing to go higher.

To qualify, applicant must be in business for a minimum of three years. Home Equity Loan Learn more about how Citadel’s home equity loan gives you a low, fixed monthly payment for large purchases. As a valued Citadel customer, we make it easy to get the cash you need. Home equity loans allow you to borrow against the equity in your home. Essentially, your home’s equity is its market value minus your mortgage balance.

Connexus home equity loans are not available in Maryland, Texas, Hawaii and Alaska. U.S. Bank home equity loans are available in all states. Home equity loans are not available in Iowa or Maryland. Navy Federal home equity loans are available in all states.

To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. Customer support by phone is available Monday through Friday from 8 a.m. Customer support is available by phone Monday through Friday from 8 a.m. Old National home equity loans are available in seven states currently.

A home equity loan can give you a lump sum of cash at a low interest rate, but you must use your home as collateral to secure the loan. Current Mortgage Information Statement –Must be dated same month as your application form, if you do not have one you can contact your mortgage lender and request one to be sent to you by email. Understanding how to use the equity in your home can be difficult, depending on your situation.

Open a certificate with a minimum deposit of just $500 and watch your savings grow. If it’s a private 1st mortgage then you will need the APSfrom your real estate agent. Most recent property tax statement-If you do not have this, then you can get the most updated statement from your local city hall. Be prepared to have financial documents at the ready such as pay stubs and Form W-2s as well as proof of ownership and the appraised value of your home. Schedule an appointment to speak with a representative today about Citadel's lending options.

You can borrow up to 89% of the CLTV ratio on your property. Right now, however, Old National’s home equity loans are only available in Illinois, Indiana, Iowa, Kentucky, Michigan, Minnesota and Wisconsin. Forbes Advisor compiled a list of the best home equity loan lenders primarily based on their starting interest rate, noting those that excel in various areas.

No comments:

Post a Comment